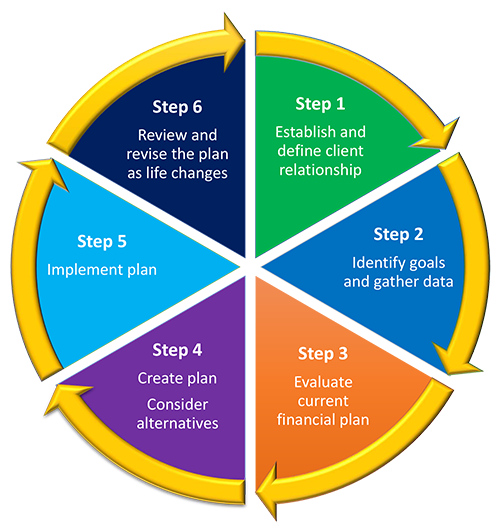

Our Process

1. Define and Establish:

1. Define and Establish:

Our first meeting is an opportunity for us to explain the financial planning process, the services provided and our industry experience. We will discuss your financial needs, concerns and risk tolerance. Together we will determine how to move forward to help you attain your financial goals.

2. Identify and Gather:

We will identify your personal and financial objectives, goals and priorities. To help with the planning process we will gather and collect important personal and financial documents such as tax returns, investment and retirement statements, 401(k) and pension documents, checking/savings account statements, and a list of liabilities. This provides a total financial picture prior to any recommendations made.

3. Evaluate:

The next step is to analyze your financial information and current plan, taking into consideration your current income, investment objectives, tax bracket, liquidity needs and family circumstances to begin preparing a suitable and personalized investment plan.

4. Create and Review:

We will create a plan and review together so we can answer questions and edit the material as needed. We will make sure all your concerns are addressed before moving forward with the implementation of your financial plan.

5. Implement:

Together, we will execute your plan to help you achieve your financial goals.

6. Review and Revise:

One of the most important components of effective financial planning is the ability to be flexible. We can meet as often as needed, in response to changes in life circumstances or financial situations. We will stay in touch through periodic updates and checkpoints. Continuous monitoring ensures that your financial goals remain on track.